OF every cedi collected in tax revenue this year, more than 55 pesewas will be used to service the debt.

When measured against this year’s projected total revenue and grants, debt service cost is estimated to wipe off more than 43 pesewas of every one cedi that will be accrued to the state.

This follows the upward revision in interest payments in the mid year budget review on June 25.

The Minister of Finance, Mr Ken Ofori-Atta, told Parliament that interest payments was expected to increase from the initial estimate of GH¢37.4 billion in the 2022 budget presented in November last year to GH¢41.3 billion.

Mr Ofori-Atta said the revision was mainly on account of inflationary pressures on interest rates, and exchange rate depreciation that resulted in higher cost of financing in the case of external interest.

Cedi fall

The minister’s concerns were reinforced by accounting and auditing firm, PricewaterhouseCooper’s (PwC), which said the increment in debt service cost was the result of the steep fall in the value of the cedi this year.

Beyond reflecting the impact of the high debt levels on the public purse, PwC said in its review of the mid year budget that the rising cost of interest payment this year was largely the result of the steep fall in the value of the cedi against the country’s major foreign trading.

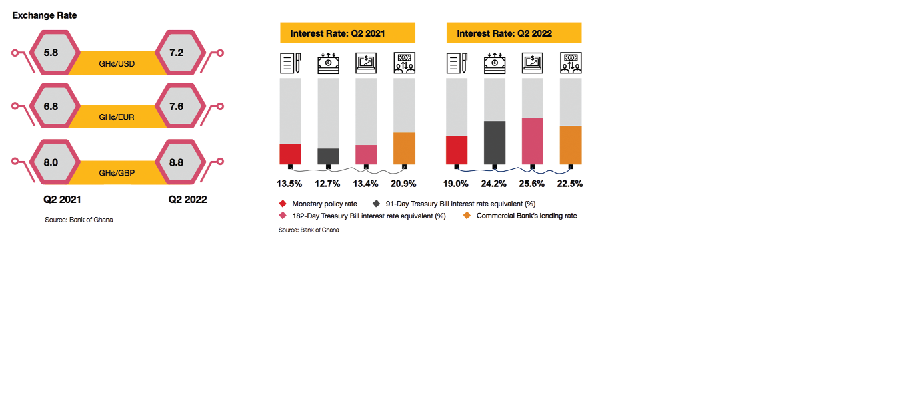

As of June 22, the Bank of Ghana (BoG) reported that the cedi had 19.2 per cent of its value to the United States (US) dollar, the highest mid year fall since 2014.

“Interest payments are expected to increase from GH¢37.4 billion to GH¢41.3 billion, accounting for 31 per cent of the total revised projected expenditure and absorbing 43 per cent of revised budgeted revenue and grants for 2022.”

“The higher interest cost is largely attributable to increases in the country’s debt stock, which has hit a concerning level, spurred by the depreciation of the cedi against major global trading currencies,” the firm said in its review released last week.

Debt stock

A major concern since the country exited the highly indebted poor countries (HIPC) of the multilateral debt relief initiative (MDRI) around 2004, the public debt has deteriorated quickly in recent years, raising concerns over its sustainability.

As of June this year, BoG reported that total debt stood at GH¢393.5 billion, equivalent to 78.3 per cent of gross domestic product (GDP).

Of the amount, it said about 51.7 per cent was being financed by external debt. PwC said in spite of the country’s debt stock in dollar terms reducing by 7.2 per cent from US$58.6 billion as at June 2021 to US$54.4 billion as at June 2022, “the significant depreciation of the cedi by about 16 per cent over the period to June 2022 has contributed significantly to the rising debt position.”

BoG reported the cedi depreciation at 19.2 per cent as of July 22. Thus in cedi terms, the US dollar component of the debt stock rose by 19.2 per cent as of June – causing the debt service cost to also quicken up.

Pressures

One key source of expenditure pressures for the budget, interest payments have already overshot their targets in the first half of the year, partly forcing a reduction in total expenditures.

Mr Ofori-Atta said in the presentation that interest payments on the public debt amounted to GH¢33.52 billion compared to the period’s target of GH¢32.53 billion, translating into a deviation of 3.1 per cent.

“Domestic interest payment amounted to GH¢26.42 billion, while external interest payment accounted for GH¢7.1 billion. The higher-than-programmed domestic interest payment was due to the government’s recourse to domestic borrowing to make-up for the shortfall in Eurobond issuance,” the minister said.

Source: graphic.com.gh