Confidential information gleaned from Bank of Ghana (BoG) correspondence of 12th May, 2016 reveal how the former deputy governor of the Bank approved needless liquidity supports to UT bank to cover up for huge indebtedness of MBG limited and Holman Brothers Ghana Ltd, all being companies owned by Ibrahim Mahama.

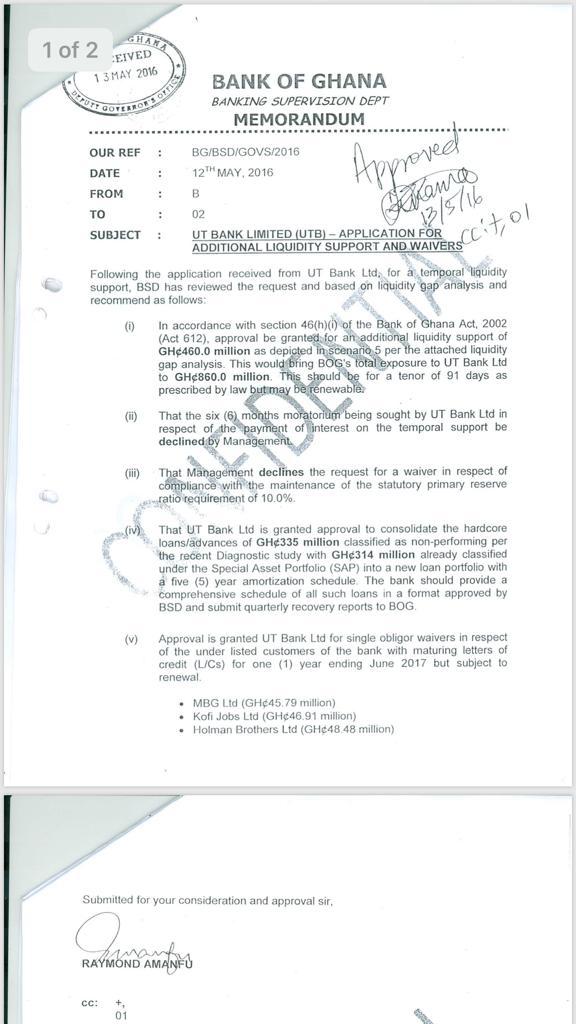

In the letter herewith attached, Dr. Asiamah gave approvals for additional liquidity support of GHc460 million bringing the total BoG total exposure to UT Bank Ltd to GHc860 million. Dr. Asiama also gave approval for the consolidation of hardcore loans/advances of GHc315 million classified as non-performing loans into a loan portfolio with a five (5) year amortization plan.

Shocking also in the approvals given by Dr. Asiama is the attempt to supply tax payers money to cover up indebtedness of companies belonging to Ibrahim Mahama, brother of John Mahama.

Paragraph five (v) of the confidential approval letter reads as “approval is granted UT Bank Ltd for single obligor waivers in respect of the under listed customers of the bank with maturing letters of credit (L/Cs) for one year ending June 2017 but subject to renewal – MBG ltd (GHc45.79 million), Holman Brothers Ltd (GHc48.48 million) and Kofi Jobs ltd (GHc46.91 million)”.

This approval, no doubt was in contravention with the single obligor clause that limits the total exposure of the bank to a single entity of up to 10%. With this approval UT Bank was unduly exposed to the companies of Ibrahim Mahama, a move that plunged UT Bank into insolvency, hence its acquisition by the Ghana Commercial Bank (GCB).

It will be recalled that in April 2017 tax liabilities redemption breaches were established by the Ghana Revenue Authority (GRA) for which 46 dud cheques were issued.

On 26th April 2017 Ghanaweb reported that “in December 2015 MBG ltd and Holman Brothers Ghana ltd had tax liabilities of GHc13,150,761.20 and GHc3,788,873.84 million respectively, to GRA as duties payable on vehicles and equipment that had been imported by MBG ltd”.

With these and many other payments breaches it was obvious that President Mahama had a clear intent of fleecing state resources to the advantage of companies belonging to his brothers and cronies.

It is therefore not surprising that in a recent Facebook engagement Mr. Mahama is still seen advocating for a continuation of the path of doling out tax payers money to support failed banks.

Discrediting this approach of fleecing the state under the guise of providing liquidity support, Vice President Bawumia described President Mahama as having lost touch with the practical means of addressing the banking sector challenges which emanated from the mismanagement of the financial sector under the previous NDC administration. This view by the Vice President has been supported by banking experts including Dr. Atuahene, a banking consultant.

Given Dr. Asiamah’s new role and acquaintances with the NDC and Mr. Mahama as the latter’s Economic and Financial Sector Advisor it is obvious the two were politicians who connived to use their officers to advance their private gains.

Read the document he sanctioned and approved below:

Source: BestNewsGH.com