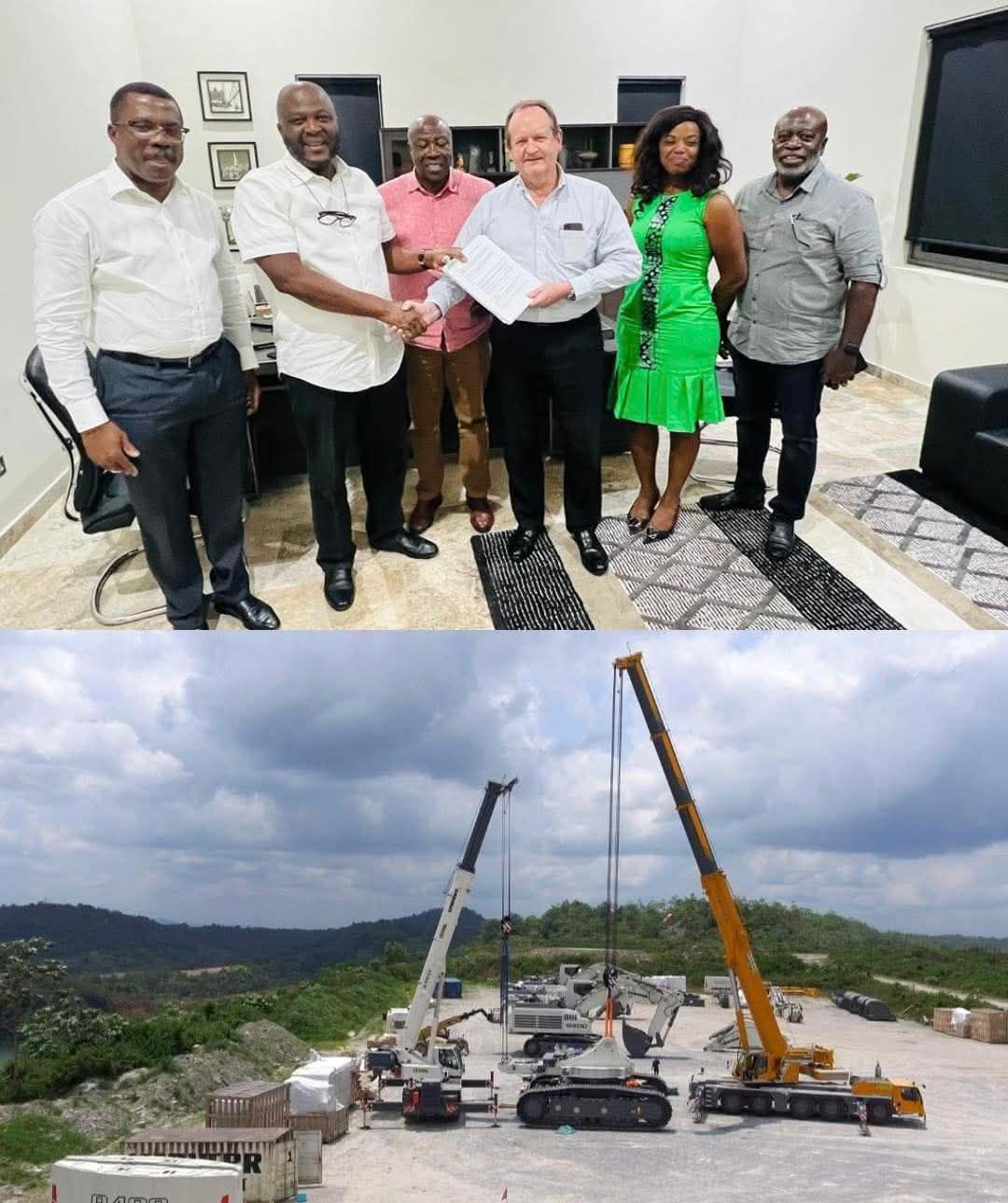

The long-dormant Black Volta and Sankofa gold projects in Ghana’s Upper West Region are set for revival after Engineers & Planners (E&P), one of West Africa’s largest indigenous mining contractors, acquired full equity in Azumah Resources Ghana Ltd and Upwest Resources Ghana Ltd.

The transaction, completed with the Registrar of Companies and the Minerals Commission, transfers all issued shares of the Ghanaian beneficial owner to E&P, marking a dramatic shift in Ghana’s mining landscape.

For nearly two decades, the concessions promised much but delivered little. Legal disputes, shifting investor priorities, and lack of capital stalled development, frustrating host communities and depriving the country of revenue.

With gold prices now above $3,000 per ounce, E&P says it is ready to deploy funding and technical expertise to fast-track mine development.

“This is a proud moment for E&P and for Ghana,” said Ibrahim Mahama, CEO of Engineers & Planners.

“Our commitment is to ensure that these projects, which have been dormant for too long, finally deliver real value to our country and its people.”

E&P has outlined a three-pronged strategy: first, auditing and verifying all historical loans with the Ghana Revenue Authority; second, repaying genuine debts; and third, deploying secured funding to launch mine construction.

An E&P executive emphasised: “We will honour all genuine obligations, but they must be properly accounted for and taxed.”

The takeover marks more than a corporate deal—it signals a reassertion of Ghanaian ownership in a sector long dominated by foreign multinationals.

For years, the concessions were controlled by offshore entities unable or unwilling to mobilise the necessary capital. Now, a homegrown company with deep mining experience has assumed responsibility.

Founded in 1997, Engineers & Planners has built a strong reputation in mining and civil engineering across West Africa, working with global majors on large-scale projects.

But this acquisition is its most ambitious move into direct resource ownership, a shift closely watched by industry observers in Accra and abroad.

If successful, E&P’s move could strengthen the case for greater localisation of mining assets, challenging the status quo where foreign ownership dominates and Ghana relies largely on royalties and carried interests.

Failure, however, could reinforce doubts about the ability of indigenous firms to mobilise the vast sums and technical know-how required for world-class mining operations.

In Wa and surrounding communities, the announcement has stirred cautious optimism. After years of delays and broken promises, hopes remain high for jobs, infrastructure, and investment.

Civil society groups, however, are demanding transparency, environmental safeguards, and equitable benefit-sharing.

“We have seen too many projects where the local people remain poor while billions are extracted from beneath their feet,” one activist warned.

For government, the deal offers both political and economic relief. It supports its narrative of economic recovery and job creation while potentially providing new revenue streams under IMF fiscal consolidation targets.

Ultimately, the Azumah-Upwest-E&P transaction will serve as a litmus test. Success would mark a turning point in Ghana’s mining story, proving indigenous ownership can thrive.

Failure would entrench the cycle of dependence on foreign capital and control.

For now, optimism holds. A once-stalled project has new life, and a Ghanaian company stands poised to turn long-held promises into production.

Source: Myjoyonline.com