Group Chief Executive of Ecobank, Jeremy Awori, says he supports calls for Bank of Ghana intervention to maintain a fairly stable cedi exchange rate, rather than the sharp daily appreciation seen in recent months.

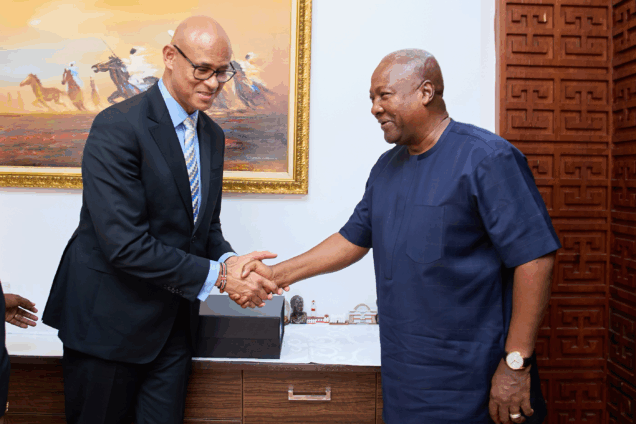

Speaking to Joy Business in Lomé, Togo, after the Annual General Meeting of Ecobank Transnational, Mr. Awori acknowledged the recent strong recovery of the cedi but emphasised the need to manage the pace of its appreciation.

“Businesses like stability and predictability, and that is very essential for banks and enterprises in Ghana,” he said.

“For us, if the rate can settle at a more predictable level, that should be exciting,” he added, stressing that stability is what businesses need most.

According to Mr. Awori, “At the end of the day, if the cedi can settle at a number and move within a narrow band, that should be seen as positive.”

Ecobank’s Group profits have taken a hit in recent times, largely due to the depreciation of the cedi and other African currencies where the bank operates.

Cedi’s Performance

The Ghana cedi has appreciated by over 30 percent against the US dollar since the beginning of 2025. However, the rate of appreciation has slowed in the past two weeks, with the currency trading around GH¢10.30 to the dollar over the last week.

Former President John Mahama recently told exporters that following consultations with the Bank of Ghana Governor and the Finance Minister, a stable rate between GH¢10 and GH¢12 per dollar may be desirable.

Cash Reserve Ratio Revision

Mr. Awori also welcomed the Bank of Ghana’s decision to revise the Cash Reserve Ratio (CRR), describing it as a prudent move that will positively impact the operations of banks, including Ecobank Ghana.

“The Group is quite optimistic about developments in Ghana and the outlook for the economy,” he said. “We are encouraged by the measures taken by economic managers in recent times.”

The revised CRR, which took effect on June 5, 2025, requires banks to maintain domestic currency reserves for cedi deposits and foreign currency reserves for FX deposits. According to the Governor of the Bank of Ghana, this approach aligns liquidity management with funding structures and enhances discipline in the foreign exchange market.

2024 Financials and Outlook

Ecobank Group closed 2024 with $2 billion in revenue, marking the first time the bank has hit that milestone since 2015. It also recorded a profit before tax of $581 million.

Mr. Awori said the 2024 financials reflect the success of the Group’s growth strategy and investments in key areas. He noted that while progress has been made, the bank remains focused on achieving its long-term goals.

“Long-term revenue growth remains the key driver of returns, value, and sustainably high returns on equity,” he added.

Source: Myjoyonline.com